Progress Made (and then) the Inevitable Mistakes

I knew going in that if I cut everything 100%, I would soon see my vices and downfalls. I knew—I mean, how could I not know—that the #1 Vice in my spending would be coffee.

And oh, yeah…it’s coffee.

To date, since starting tracking everything, which began 8/15/22, I have purchased three coffees. THREE. On a normal “whatever” no budgeting type of week, I would have stopped nearly every morning for coffee and thrown in a donut or brekkie sandwich, so I’m not going to beat myself up for grabbing 3 Grande Pikes in a 2 week period. I can do better, but at $2.95/pc, I’m still okay.

But the other vice, I’ve found, is even worse! I intend to rectify my bad habits with DoorDash.

Tired, long hours, sick, busy: these are the buzzwords that keep DoorDash afloat, and they 100% are the reasons I tell myself to “go ahead and order.” I’m actually writing this currently with some DoorDashed Indian food. Womp, womp.

Not only is DoorDash riddled with delivery fees because of the convenience, but it’s also JUST PRICED HIGHER to build in profit. I work in sales management, and I understand that profits must be made where we can and then shuffled through operations in order to pay our overhead. It doesn’t mean I have to fall prey to these costs elsewhere, right?

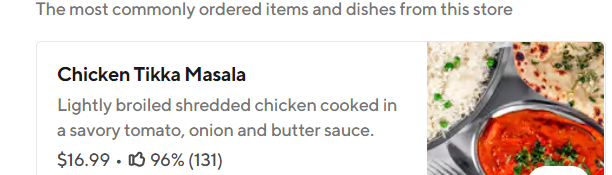

Let’s take this Indian Food, for example. On Door Dash, my go-to meal is

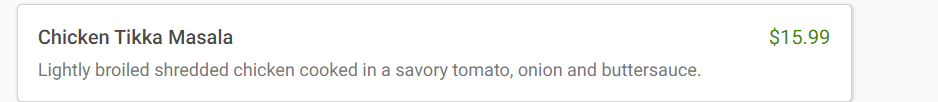

And at the restaurant, this go-to meal is:

It was only $1.00 more, but these recurring charges do add up. When I forgot to bring lunch, I DoorDash. When I’m super tired and heading home from work, I check in with my husband and see how he feels. If we’re both in that same headspace, I jump in, have food delivered, and don’t think about the expense.

This exercise is supposed to MAKE me think about the expenses, so I am. And it DOES add up, particularly because my goal is to eat at home. The answer here is to MAKE SURE that home has easy meals intermingled with the meal plan of homemade dishes. On my next shopping list, I’ve included frozen pizzas and some microwaveable entrees that can fill this gap.

So far, the slip-ups have cost me :

- Coffee-$8.85

- Food Delivery-$164.52

I do have positive news about the close look at spending and purchasing during the first month of my One Year Purchase Ban:

It has helped me use Excel way more, and God knows I love a good spreadsheet.

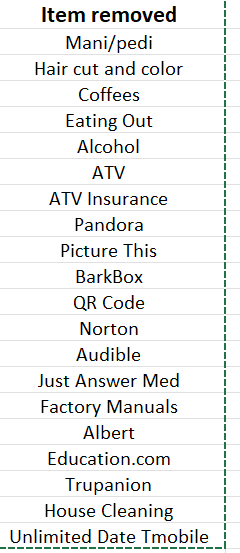

The REALLY good news is that I have trimmed what seems like a ridiculous amount: $19,000 annually. I checked and checked and rechecked this math. What adds up in my life are services, mainly. Manis/Pedis, hair cut and color, BarkBox (sorry, pups), streaming services, and convenience items like house cleaning. Those are things I’m willing to give up. On the PETS side of the expenses, I am not willing to compromise on their food and medicine, but I know I can do better with toys and accessories. The entire list of items and services that I have trimmed or canceled:

That’s a pretty long list. Alcohol has never been a big bill for me; I’m topped out at one beer when I DO drink because of my Brain Injury. You may notice “ATV” and “ATV Insurance” on this list and find yourself wondering WHAT she was thinking. Well, we live in the woods, and our driveway gets iced and snowed over through the winter, so the ATV was fun but ALSO practical because it had a snow plow. I decided we could live without this additional cost and sold the ATV.

I don’t know if we can attach a snowplow to a Nissan Maxima, so this winter may get interesting. Either way, the monthly expense didn’t make sense for a tool that really only gets to shine 3 months out of the year.

I know that when starting this project, I was rather reckless with spending, but never in my life did I think forgoing some services would save me this much money. Naturally, having been wreckless, the money I save I don’t really see. It’s going straight into Debt Management (another big, long, WOMP WOMP.)